Product Detail

up to 18% per annum.

6 months to 60 months

RM250 to RM100,000

Eligibility

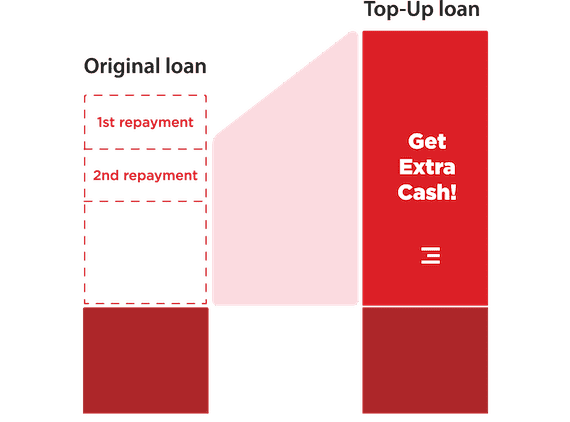

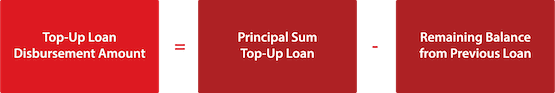

Entitle for Existing Customer that has an existing contract with remaining loan amount.

ACOM(M) will set the criteria for the top-up loan, based on the repayment status of the previous loan.

Documents Required

Malaysian Identification Card (MyCard)

Latest 2 months salary crediting bank statement (in PDF)

Latest 2 months salary slip (in PDF) And/or

Latest EPF statement (in PDF)

Latest utility bill (water, electricity, etc.)

Only needed, if address changed or different from 1st application

Others as required by ACOM(M) (if any)

Loan calculator

You can simulate your monthly instalment amounts. Please use this information to help you plan your repayments.

Loan Amount (RM)

Annual Interest Rates (%)

18%

Loan Tenure (Months)

Monthly instalment

FAQs about personal loan

If I borrow RM3,000, what is the repayment schedule?

Loan Amount: RM3,000

Tenure: 12 months

Interest Rate: 18.0% per annum

Fees: RM15 stamp duty fee and RM10 attestation fee

| (RM) | Principal Balance | Monthly Instalment Amount | ||

|---|---|---|---|---|

| Principal Amount | Interest Amount | |||

| Disbursement: | 3,000 | - | - | - |

| 1st due | 2,788.08 | 295.00 | 211.92 | 83.08 |

| 2nd due | 2,569.23 | 295.00 | 218.85 | 76.15 |

| 3rd due | 2,343.46 | 295.00 | 225.77 | 69.23 |

| 4th due | 2,110.77 | 295.00 | 232.69 | 62.31 |

| 5th due | 1,871.15 | 295.00 | 239.62 | 55.38 |

| 6th due | 1,624.61 | 295.00 | 246.54 | 48.46 |

| 7th due | 1,371.15 | 295.00 | 253.46 | 41.54 |

| 8th due | 1,110.77 | 295.00 | 260.38 | 34.62 |

| 9th due | 843.46 | 295.00 | 267.31 | 27.69 |

| 10th due | 569.23 | 295.00 | 274.23 | 20.77 |

| 11th due | 288.08 | 295.00 | 281.15 | 13.85 |

| Final | 0.00 | 295.00 | 288.08 | 6.92 |

| Total: | 3,000.00 | 3,540.00 | 3,000.00 | 540.00 |

How do I apply for a Personal Loan?

You may apply online here, anytime.

If you need future assist and more information, please text via WhatsApp: 03-2382-8020.

How much loan I can apply for?

For First Loan, you can borrow with minimum 0.5 up to 1.0 and maximum RM100,000. The amount that you can borrow varies depends on individual credit scoring evaluation.

However, for Top-Up and subsequent loans, the minimum is 0.5 and the maximum will be determined by ACOM(M)

What documents & eligibilities are required?

- Document Required

- 1. Malaysian Identification Card (MyCard)

- 2. Latest 2 months salary crediting bank statement (in PDF)

- 3. Latest 2 months salary slip (in PDF) And/or

- 4. Latest EPF statement (in PDF)

- 5. Latest utility bill (water, electricity, etc.)

*within latest 2 months - Others as required by ACOM(M) (if any)

- Eligibility for Online Application

- 1. Individual aged 18 to 60 years

- 2. Minimum monthly gross income of RM500

- 3. Private and government employee Only

- 4. Malaysian Citizen

- 5. Not declared bankrupt

- 6. Not a political exposed person

- Eligibility for Top-up Application

- 1. Entitle for Existing Customer that has an existing contract with remaining loan amount.

- 2. Good payment history with ACOM(M)

- 3. Individual aged 18 to 60 years

- 4. Minimum monthly gross income of RM500

- 5. Private and government employee Only

- 6. Malaysian Citizen

- 7. Not declared bankrupt

- 8. Not a political exposed person

I’d like to contact ACOM Malaysia for personal loan application details

If you need future assist for a fast cash loan, please text via WhatsApp: 03-2382-8020.

Application and contracting can be completed via online application. However, only selected customers will be summoned to our office for verification process.

The annual interest rate is up to 18.0%.

The minimum loan tenure is 6 months and the maximum loan tenure is 60 months (5 years)

* Subject are depends on individual credit scoring evaluation.